Property development in Nigeria is one of the most lucrative yet misunderstood industries. Many assume you need millions to start, but the truth is, smart strategies like joint ventures, off-plan sales, and government partnerships can help you break into the market with little or no capital.

This guide will walk you through how to start a property development business in Nigeria, even if you’re starting from scratch.

What Is Property Development?

Property development is the process of transforming raw land, underutilized buildings, or outdated structures into profitable real estate assets. Many people interested in getting into property development believe they need vast capital, but strategic approaches can help them start with minimal investment.

Unlike simple real estate trading, development involves multiple stages—land acquisition, feasibility studies, securing permits, construction, and sales or leasing. Developers act as project managers, coordinating architects, engineers, contractors, and government agencies to bring a vision to life.

In Nigeria, property development is a high-reward but high-risk venture due to factors like fluctuating material costs, bureaucratic delays, and land disputes. However, with proper planning and risk mitigation strategies, it remains one of the fastest ways to build generational wealth. Successful developers don’t just build houses; they create communities, enhance neighborhoods, and contribute to economic growth.

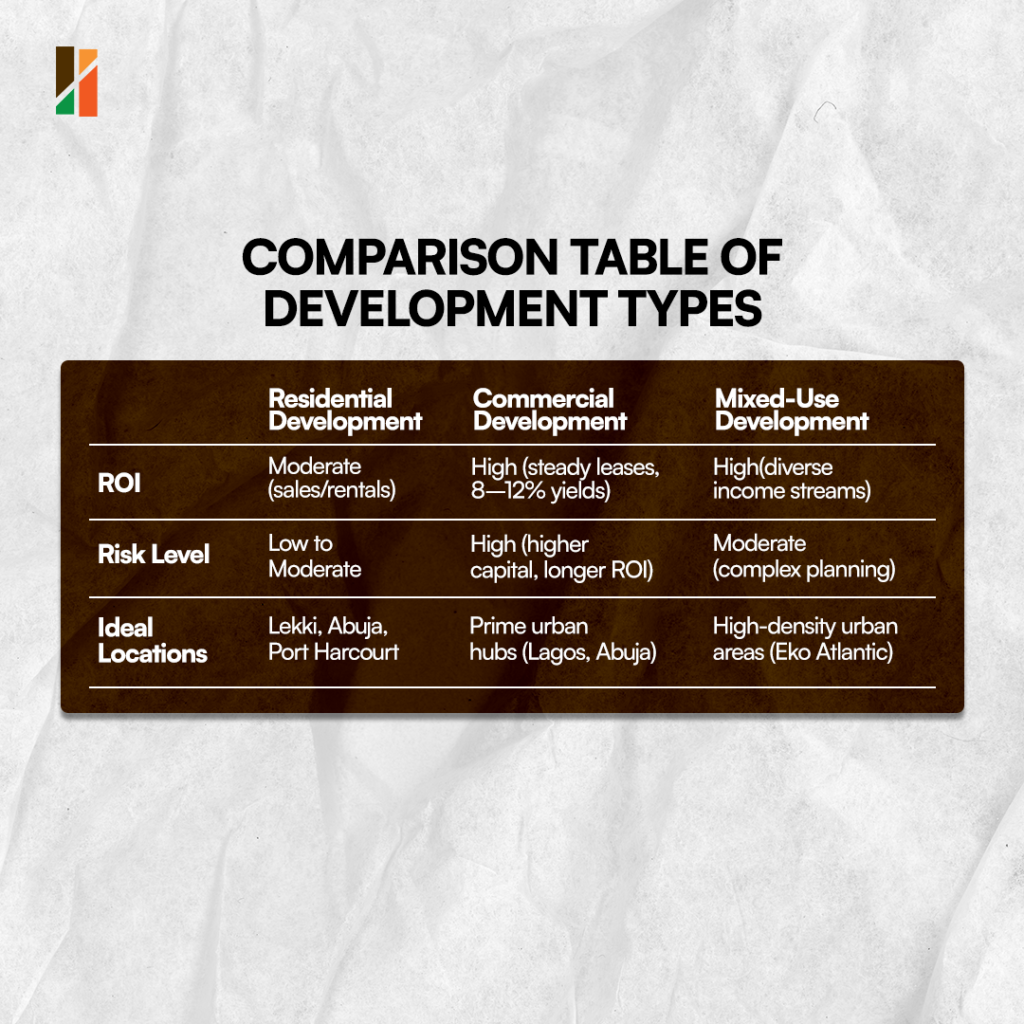

The industry is divided into residential, commercial, and mixed-use developments, each requiring different expertise and capital structures. Whether you’re building a block of flats in Lagos or a shopping complex in Abuja, understanding the full development cycle is crucial for profitability.

Types of Property Development in Nigeria

1. Residential Development

Residential property development involves constructing homes for individuals and families. This category includes luxury apartments (e.g., Autograph Lagos), mid-range estates (e.g., Redbrick Homes), and affordable housing projects (e.g., Famfa Estate). The demand for housing in Nigeria is massive, with a deficit of over 20 million units, making this a high-potential sector.

Developers can focus on short-term rentals (serviced apartments) or long-term sales. Real estate development courses in Nigeria can help you understand which strategy best fits your financial goals and market trends. Key locations include Lekki, Abuja, Port Harcourt, and Ibadan, where urbanization is driving demand. Financing options include personal savings, bank loans, and off-plan sales, where buyers pay upfront before construction begins.

2. Commercial Development

Commercial property development caters to businesses, including office complexes, shopping malls, hotels, and industrial parks. Examples include The Wings Towers in Lagos and Jabi Lake Mall in Abuja. These projects require higher capital but generate long-term income through leases.

A major advantage of commercial real estate is steady rental yields (8–12% annually in prime areas). However, developers must consider factors like location accessibility, parking space, and tenant preferences. Partnerships with corporate organizations (e.g., banks, retail chains) can provide pre-leasing opportunities, reducing financial risk.

3. Mixed-Use Development

Mixed-use developments combine residential, commercial, and sometimes recreational spaces in a single project. Examples include Eko Atlantic and Maryland Mall in Lagos. These projects maximize land use and attract diverse income streams.

Mixed-use properties are ideal for high-density urban areas where space is limited. They appeal to modern buyers who want live-work-play convenience. However, they require meticulous planning to comply with zoning laws and ensure the harmonious coexistence of different property types.

How to Start Property Development with No Money (4 Proven Models)

1. Joint Ventures (JV) with Landowners

Joint venture property development allows you to partner with a landowner instead of buying property outright. The typical structure is a 60/40 profit split, where you handle approvals, construction, and sales while the landowner provides the asset. This model is common in emerging areas like Ibeju-Lekki, Epe, and Abuja outskirts, where landowners lack development expertise.

To succeed, draft a clear JV agreement outlining responsibilities, profit-sharing, and dispute resolution. Engage a lawyer to ensure the land title is clean and the contract is binding. Many Nigerian millionaire developers, like Cecil Osakwe of Havilla Homes, started with JVs before scaling to independent projects. If you’re wondering how to become a property developer with no money, joint ventures provide a great entry point into the industry.

2. Off-Plan Sales (Pre-Selling Units)

Off-plan sales involve marketing and selling properties before construction begins. This strategy generates upfront cash flow to fund development.

To attract buyers, offer discounted pre-launch prices (around 10–20% below market value) and flexible payment plans. Use 3D renders, virtual tours, and brochures to showcase the final product. Partner with real estate agents to reach a wider audience. The key is trust, so ensure you deliver on promises to avoid legal disputes.

3. REITs and Crowdfunding Platforms

Real Estate Investment Trusts (REITs) and crowdfunding platforms have emerged as innovative financing solutions in Nigeria’s property market. UPDC REIT and other platforms allow multiple investors to pool resources for large developments with low-entry investment capital. This model works particularly well for mid-to-large-scale projects that require substantial capital.

The advantages include risk diversification and professional management, as REITs are handled by experienced fund managers. Developers can either list their projects on these platforms or invest in existing REITs to gain exposure to the market.

However, this approach requires due diligence. You’ll need to examine the track record of the REIT manager, projected returns, and exit strategies. Some platforms specialize in specific property types (residential, commercial, or mixed-use), so choose one that aligns with your development goals.

4. Government Partnerships (PPP)

Public-Private Partnerships present unique opportunities in Nigeria’s affordable housing sector. Various state governments, particularly Lagos and Abuja, actively seek private developers to execute housing projects under PPP arrangements. These often come with benefits like discounted land, tax incentives, and infrastructure support.

The Federal Government’s National Housing Program and states like Lagos’ Rent-to-Own scheme provide ready-made markets for completed units. To participate, developers must meet specific criteria, including financial capacity, technical competence, and compliance with building standards.

The application process typically involves submitting proposals through the Ministry of Housing or relevant state agencies. While the bureaucratic process can be lengthy, the guaranteed offtake and support make this a viable option for developers willing to navigate government systems.

Comparison Table: Property Development Models

| S/N | Model Name | Core Concept | Key Actions/Requirements | Primary Benefit(s) | Key Consideration(s) |

|---|---|---|---|---|---|

| 1 | JV with Landowner | Partner: Landowner gives land, developer builds/sells (e.g., 60/40 split). | Clear JV agreement (roles, profit), legal title check. | No land purchase cost; good entry point. | Solid legal contract essential. |

| 2 | Off-Plan Sales | Sell units before construction begins to fund project. | Offer discounts/plans, quality marketing (renders), use agents. | Generates upfront cash flow. | Must deliver on promises (trust). |

| 3 | REITs/Crowdfunding | Pool funds from many investors via specialized platforms. | Vet platform/manager; understand structure, terms & risks. | Access large capital; risk diversification. | Requires thorough due diligence. |

| 4 | Government Partnership (PPP) | Partner with government (state/federal) on housing projects. | Meet criteria (financial, technical), submit proposals via agencies. | Incentives (land, tax); ready market/offtake. | Potentially lengthy bureaucracy. |

Each of these models has successfully launched numerous Nigerian developers into the industry. The choice depends on your risk appetite, available resources, and long-term goals. Many top developers combine multiple models – using JVs for land acquisition, off-plan sales for financing, and eventually REITs for portfolio expansion. The key is starting with what’s accessible to you now while planning to scale into more sophisticated models as your experience and capital grow.

Essential Real Estate Developer Skills

1. Reading and Interpreting Floor Plans (Technical Skill)

Floor plans are the blueprint of any construction project. As a developer, you must understand architectural drawings, structural designs, and MEP (Mechanical, Electrical, Plumbing) layouts. This knowledge helps you:

- Verify if contractors are following specifications

- Identify potential design flaws early

- Communicate effectively with architects and engineers

In Nigeria, common standards include the Nigerian Building Code and local authority requirements. Many new developers take short courses at institutions like NIESV or online platforms to master this skill.

2. Construction Costing and Budgeting (Technical Skill)

Accurate cost estimation separates profitable developers from those who run into financial trouble. One of the core real estate developer skills is understanding how to budget for land acquisition, construction, and project management. You must also know:

- Current material prices

- Labor rates

- Professional fees

Developers should maintain relationships with multiple suppliers to get competitive pricing. Always include a 15-20% contingency for Nigeria’s volatile construction market. Many developers also explore cheap construction methods in Nigeria, such as interlocking bricks and alternative roofing solutions, to cut costs.

3. Negotiation Tactics (Soft Skill)

Land acquisition in Nigeria requires street-smart negotiation:

- Understand family land dynamics (multiple heirs often claim ownership)

- Use local intermediaries (“omo onile” brokers) carefully

- Never pay the full amount upfront – use staged payments tied to milestones

Successful developers like Xymbolic Development maintain negotiation playbooks for different scenarios.

4. Risk Management

Nigerian-specific risks include:

- Title disputes

- Construction delays (due to rainy season and other factors).

- Currency fluctuations (imported materials cost variability)

However, you can mitigate risks by following best practices and strategies, such as:

- Conduct due diligence at Lands Bureau

- Purchase title insurance (available from STACO Insurance)

- Hedge forex risks for imported materials

Step-by-Step Launch Plan

1. Education and Preparation

Becoming a successful property developer in Nigeria begins with acquiring the right knowledge. Unlike many businesses where you can learn on the job, real estate development requires a foundational understanding before committing funds. Aspiring developers should dedicate 3-6 months to intensive learning through multiple channels.

The Nigerian Institution of Estate Surveyors and Valuers (NIESV) offers specialized certification programs covering critical areas like land valuation, construction management, and property laws. These programs are a bit pricey but provide locally relevant knowledge you won’t find in international courses.

For those who prefer flexible learning, online platforms like Coursera and Udemy offer affordable real estate development courses. However, the most valuable education often comes from mentorship. Joining professional associations like REDAN (Real Estate Developers Association of Nigeria) gives access to networking events where you can learn from established developers.

Many successful developers attribute their start to mentors who guided them through their first projects. The learning phase should cover three key areas: Nigerian property laws, construction project management, and financial modeling for real estate developments.

2. Business Registration and Structuring

Once equipped with knowledge, the next critical step is legally establishing your development business. The choice of business structure significantly impacts your liability, tax obligations, and ability to raise capital. For solo developers starting small, a Sole Proprietorship registered with the Corporate Affairs Commission (CAC) may suffice initially. However, most serious developers opt for a Limited Liability Company, as it provides better protection for personal assets and makes it easier to secure partnerships.

After registration, developers need to complete several compliance steps:

- Obtain a Tax Identification Number (TIN) from FIRS.

- Register for VAT depending on annual turnover.

- Secure necessary local government permits.

- Open a dedicated corporate bank account.

Nigerian Market Realities

1. Regulatory Environment

Navigating Nigeria’s property development regulations requires strategic planning and patience. Developers must comply with Nigerian building regulations, including zoning laws, environmental approvals, and permit processes. Lagos State, being the most developed market, has the most stringent requirements, with approval timelines stretching 6-12 months for medium-scale projects.

The process involves multiple agencies, such as LASPPPA for planning permits, LASEPA for environmental compliance, and the Urban Planning Department for zoning clearances. Developers in emerging markets like Ogun State often benefit from faster approval timelines (3-6 months) and more flexible requirements, though land titles may be riskier.

The approval process becomes particularly complex for large-scale developments exceeding 50 units. Such projects require Environmental Impact Assessments (EIAs) with high costs, public hearings, and sometimes state executive council approval. Smart developers factor these timelines into their project schedules, often beginning the approval process while finalizing designs to save time. Recent reforms like Lagos State’s electronic planning permit system have slightly improved efficiency, but personal follow-ups with officials remain crucial.

2. Financial Considerations

Understanding the true cost of property development in Nigeria separates successful developers from those who abandon projects midway. While construction costs are often the focus, numerous hidden expenses catch beginners off guard. Land banking strategies can also help developers secure land at a lower price before rapid appreciation.

Professional fees alone consume around 10-20% of project budgets, covering architects, engineers, and legal services. Infrastructure costs present another major expense category, with developers spending millions on boreholes, transformers, and other infrastructure.

FAQs

1. Can I start property development with no experience?

Yes, but you’ll need to partner with professionals like architects, contractors, and lawyers. Many successful developers began by learning through joint ventures or small-scale projects before expanding.

2. What’s the cheapest way to acquire land for development?

Joint ventures with landowners are the most cost-effective. Instead of buying outright, propose a profit-sharing model (e.g., 60/40 split) where you develop their land.

3. How long does it take to get government approvals?

In Lagos, expect 6–12 months for permits. In states like Ogun or Abuja, approvals may take 3–6 months. Always factor this into your timeline.

4. What’s the minimum budget for a starter project?

The cost of a project varies depending on the nature and location of the project. Regular property developments cost less than luxury property developments. We may peg an average of N100-200 million for a 4-unit apartment in Lekki.

5. How do I fund my first project without a bank loan?

- Off-plan sales (pre-selling units before construction)

- Joint ventures (partnering with landowners)

- Crowdfunding (through REITs or private investors)

6. What are the biggest risks in Nigerian property development?

- Land disputes (verify titles at the state Lands Bureau)

- Construction delays (weather, funding, or approval setbacks)

- Cost overruns (always budget a 15–20% contingency)

7. Which areas in Lagos offer the best ROI for new developers?

- Ibeju-Lekki (emerging, lower land costs)

- Epe (future growth potential)

Conclusion

Property development in Nigeria is a lucrative but complex venture that requires strategic planning, patience, and risk management. While many assume you need millions to start, models like joint ventures, off-plan sales, and crowdfunding make it possible to enter the market with limited capital. The key is starting small—focus on a manageable first project, build industry connections, and prioritize proper documentation to avoid legal pitfalls.

Success in real estate development doesn’t happen overnight, but with the right guidance, it can become your most rewarding wealth-building venture. Ready to take your first step? Follow our blog and newsletter for tips to help you get started.